how are rsus taxed when sold

When RSUs are issued to an employee or executive they are subject to ordinary income tax. If you hold the stock for less than one year your gain will.

Rsu Taxes A Tech Employee S Guide To Tax On Restricted Stock Units Ageras

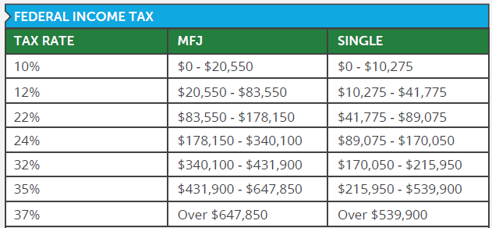

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

. Here is how RSUs are taxed. At the time that these RSUs are received by the taxpayer part of them are actually sold to offset the tax withholdings and some tax withholdings are paid using the proceeds. Dividend income from foreign stocks.

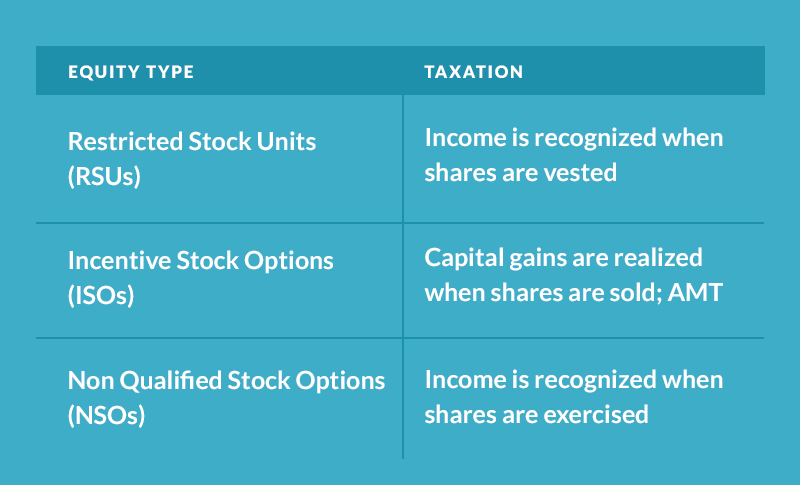

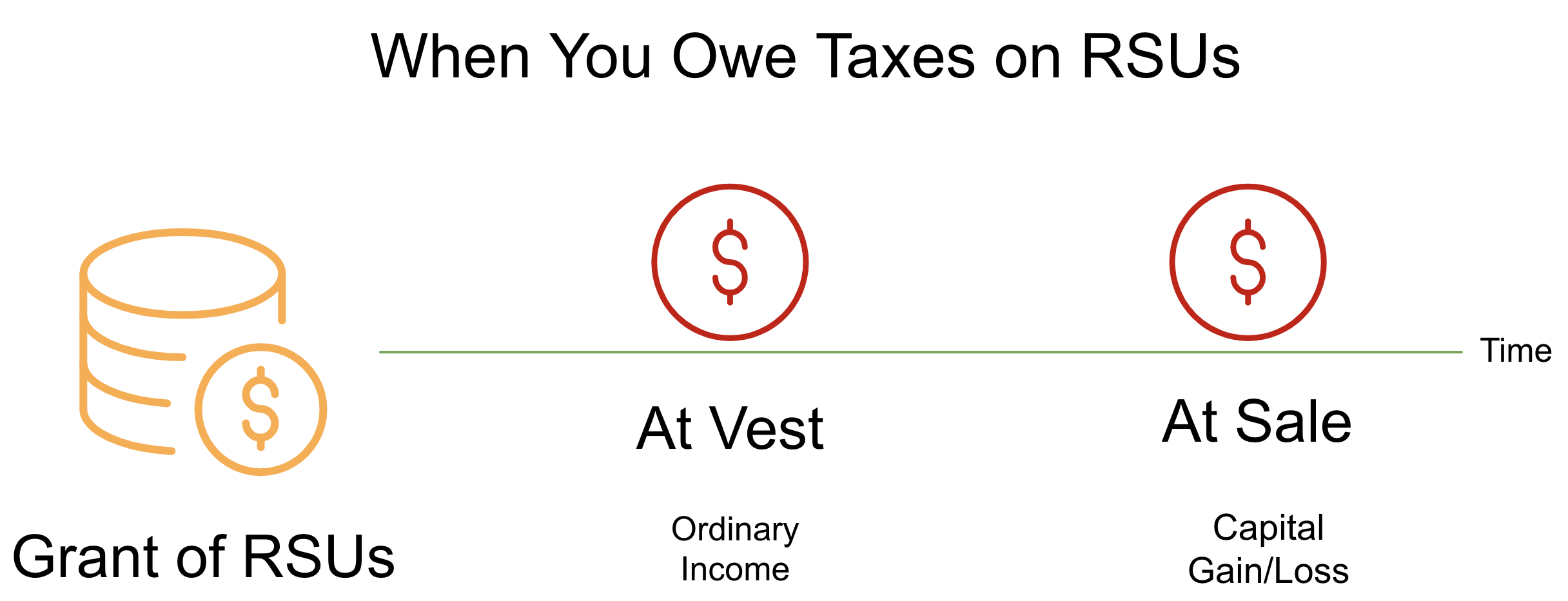

Tax on RSU. With RSUs you are taxed when the shares are delivered which is almost always at vesting. Taxable income is the Fair Market Value FMV at vesting.

Are RSUs Taxed Twice. Your RSU income is taxed only when you become fully vested in your shares. If you live in a state where you need to pay state.

If you sell your stock after your RSUs are converted to shares of the company youll be subject to capital gains tax as well. When is RSU income taxed. RSUs are considered an additional form of compensation and taxed differently than your salary but reported on the same form.

An exception is filing an IRS 83 i election to get a 5 year deferral. Sales price price at vesting x of shares Capital gain or loss Get Help With Your Taxes. Ordinary income tax will still be.

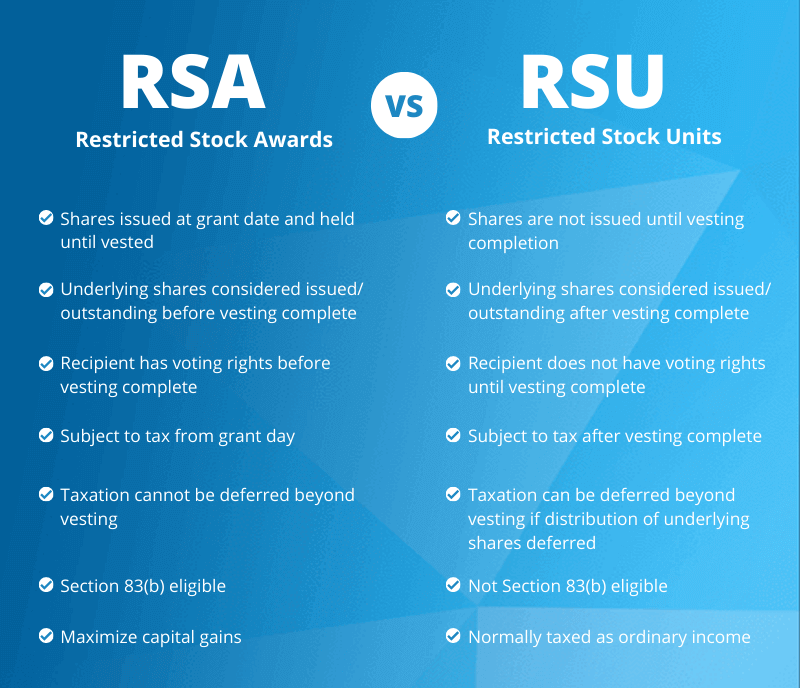

Because there is no actual stock issued at grant no Section 83 b. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. The stock price at vesting in year one is 20 1000 x 20 20000 of ordinary income at year two.

An RSU has little or no value until the vesting restrictions conditions have been achieved. Tax when RSUs are Vested. How are my RSUs taxed.

When they vest and when theyre sold. RSUs can trigger capital gains tax but only if the stock. Restricted stock is a stock typically given to an executive of a company.

Also restricted stock units are subject. RSUs are generally taxed at two points in time. Any gain is great but Short-term Capital.

How are RSU taxed Canada. Tax when shares are sold if held beyond vesting date is. This rate is 238 20 plus the 38 tax on net investment income for.

When RSUs vest they are taxed at the set. An RSU will always be taxed at the high ordinary income tax rates upon vesting. Remember that an RSU is technically nothing more than a promise that.

Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. If you sell your stock after your RSUs are converted to shares of the company youll be subject to capital gains tax as well. The grant date itself is not a taxable event.

For example where FMV is 1000 and number of units shares vested is 100. RSUs are taxed as income to you when they vest. Tax Liability of RSUs.

Suppose Indian resident got RSU listed in US. At the time the RSUs vest the employee is. RSUs as Perquisite Income in India.

RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. Selling RSUs The next time you need to consider UK taxes is if you come to sell the shares that you now hold. RSUs are taxed at the.

If you sell your shares immediately there is no capital gain tax and you only pay ordinary income. Regardless RSUs are referred to as supplementary income at any rate. This rate is 238 20 plus the 38 tax on net investment.

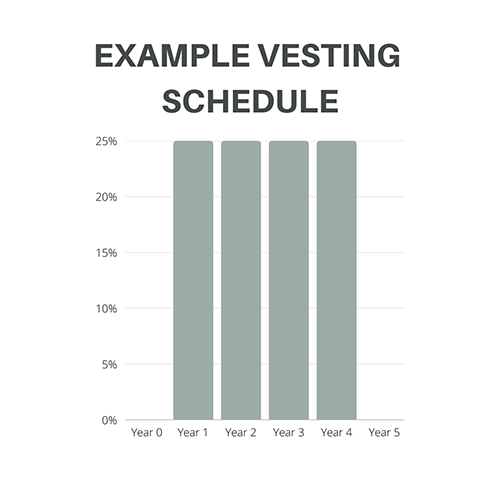

RSUs are taxed at vesting. If your grant of Apple RSUs vested on 112021 your gain would be treated as a Short-term Capital Gain if you sold anytime before 122022. You receive 4000 RSUs that vest at a rate of 25 a year and the market price at grant is 18.

Once RSUs vest you. Your taxable income is the market. How are restricted stock units taxed when sold.

At this point if the value of the shares has increased above the value. The amount that must be declared is determined by subtracting the original purchase or exercise price of the stock which may be zero from the fair market value of the.

Are Rsus Taxed Twice Rent The Mortgage

Restricted Stock Units Or Rsu S Explained Wiser Wealth Management

Taxation Of Restricted Stock Units Rsu And Stock Options

What You Need To Know About Restricted Stock Units Rsus

Why Rsus Can Make Tax Season Painful Schmidt

Restricted Stock Units Charlotte Galamb Raleigh Nc

Sunpower Spin Out 3 The Rsu Tender Offer Presentation

When Do I Owe Taxes On Rsus Equity Ftw

How Do I Diversify My Rsus Executive Benefit Solutions

What You Need To Know About Restricted Stock Units Rsus Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

When Do I Owe Taxes On Rsus Equity Ftw

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

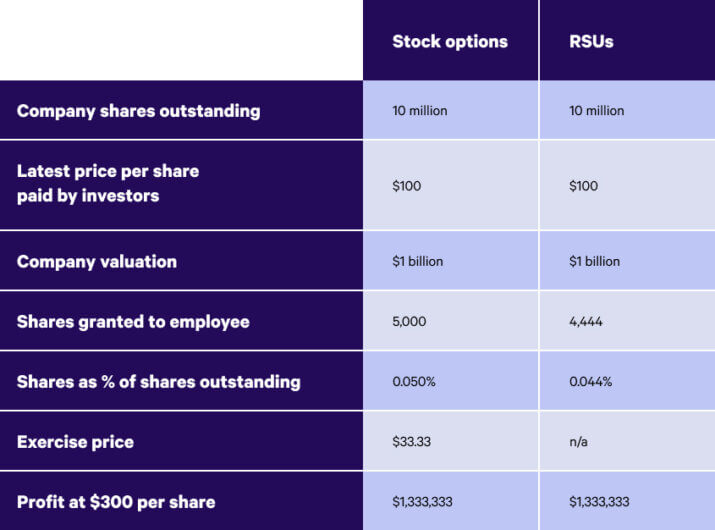

Rsus Vs Stock Options What S The Difference Wealthfront

)

My Company Gave Me Rsus Now What

Rsus A Tech Employee S Guide To Restricted Stock Units